Flat Fee Money Lending Business Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

DESCRIPTION

Recent Upgrades: Added a three statement model and capitalization table.

There are all kinds of money lending businesses, this specific financial model focuses on one that charges a flat fee per loan (percentage multiplied by loan amount).

In this kind of loan, the user simply has to pay a known amount either at the end of the term or evenly over the term. The model has a selector for the user to pick which one.

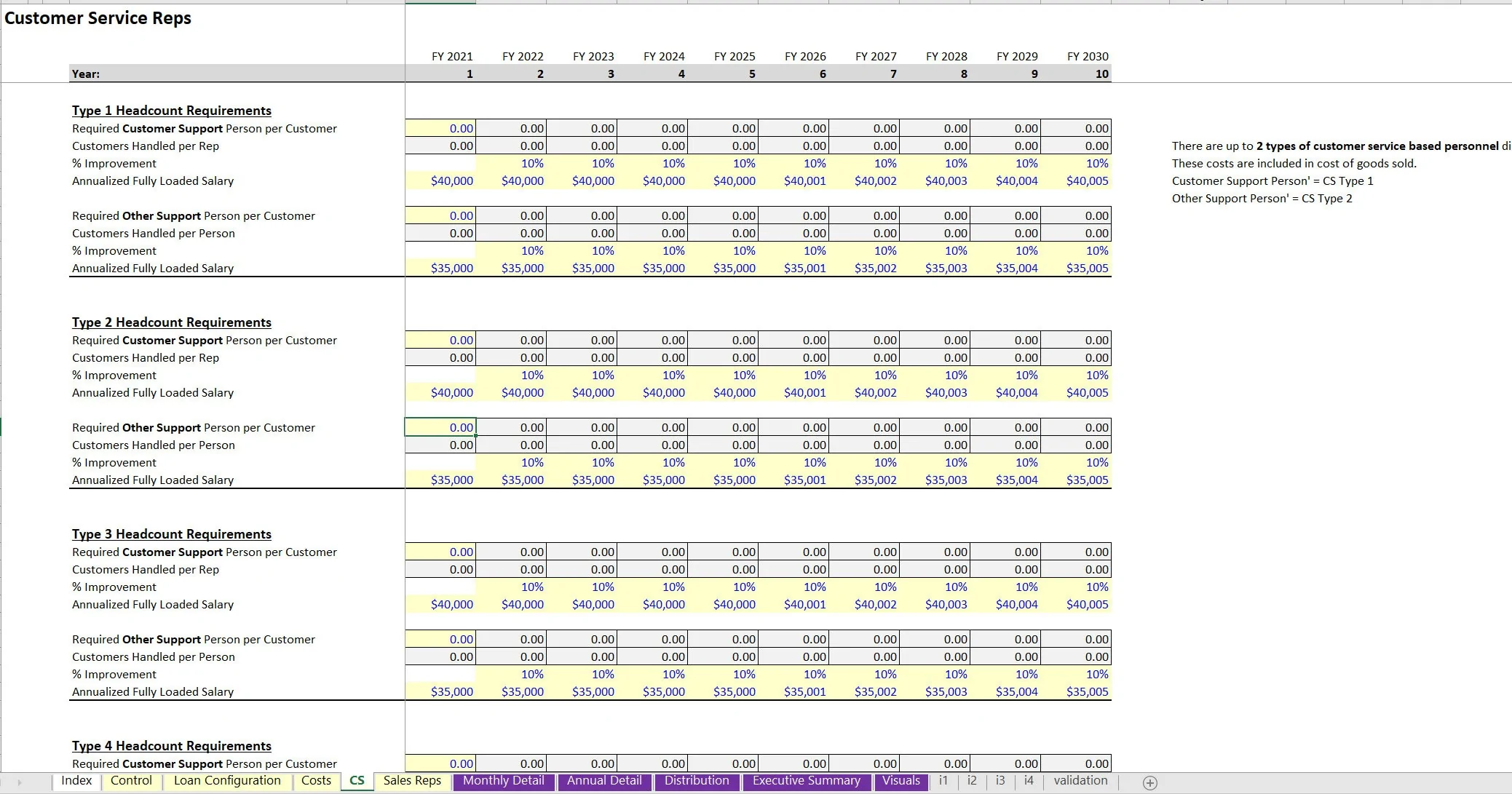

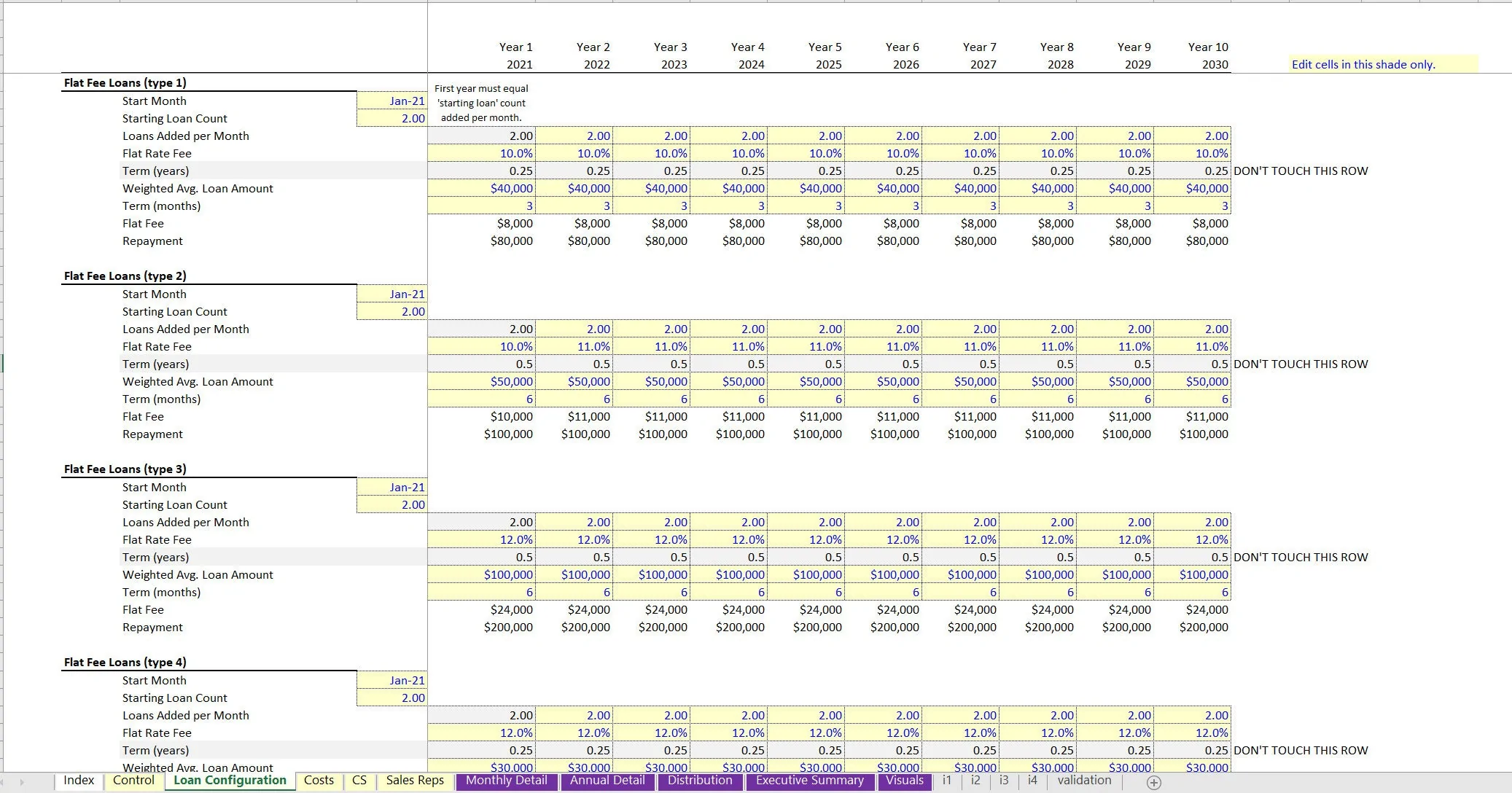

The model lets the user define up to 4 separate loan configurations, which vary by the following:

• Start Month

• Starting Loan Count

• Loans Added per Month (adjustable per year)

• Flat Rate Fee (adjustable per year)

• Term (years) (adjustable per year)

• Weighted Avg. Loan Amount (adjustable per year)

• Term (months) (adjustable per year)

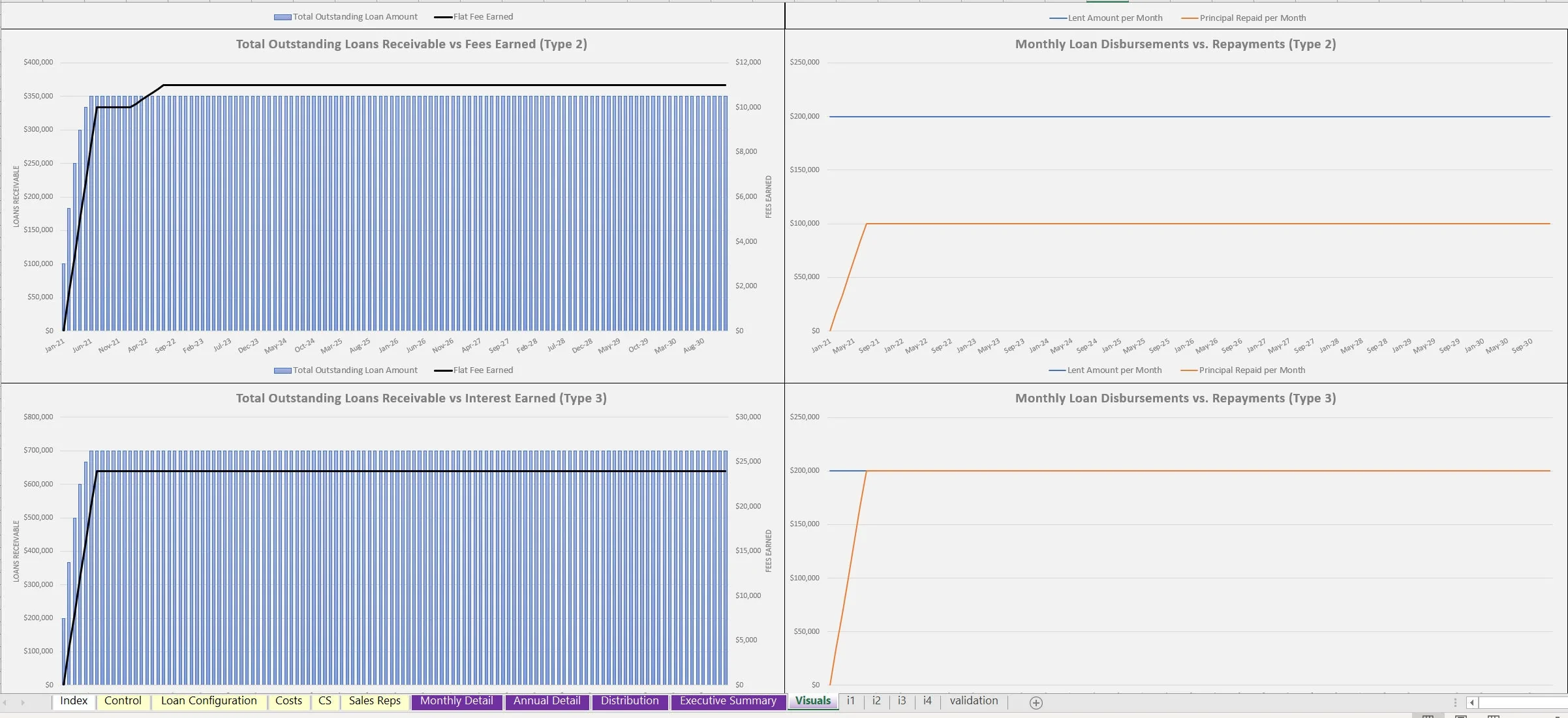

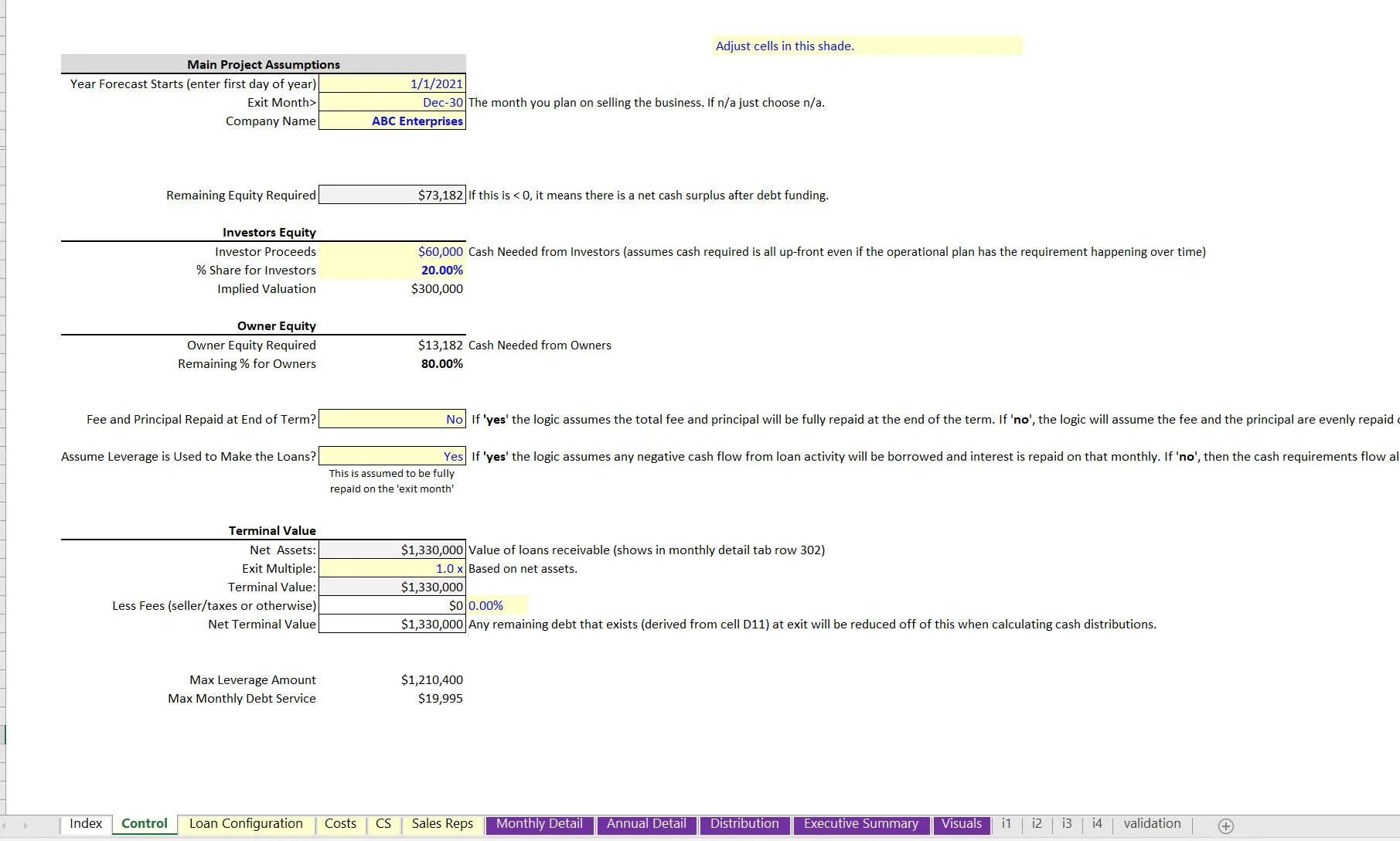

There is a (yes/no) selector to determine if the borrower will repay the flat fee and total principal amount back at the end of the term or evenly over the term. The other aspect of this business model is leverage and there is a (yes/no) selector to define if a loan facility is used in funding initial originations.

A money lender may target loans with an average term of 3 months with a 10% flat fee and they may borrow money on a line of credit or some rolling facility that charges something like 15-18% APR.

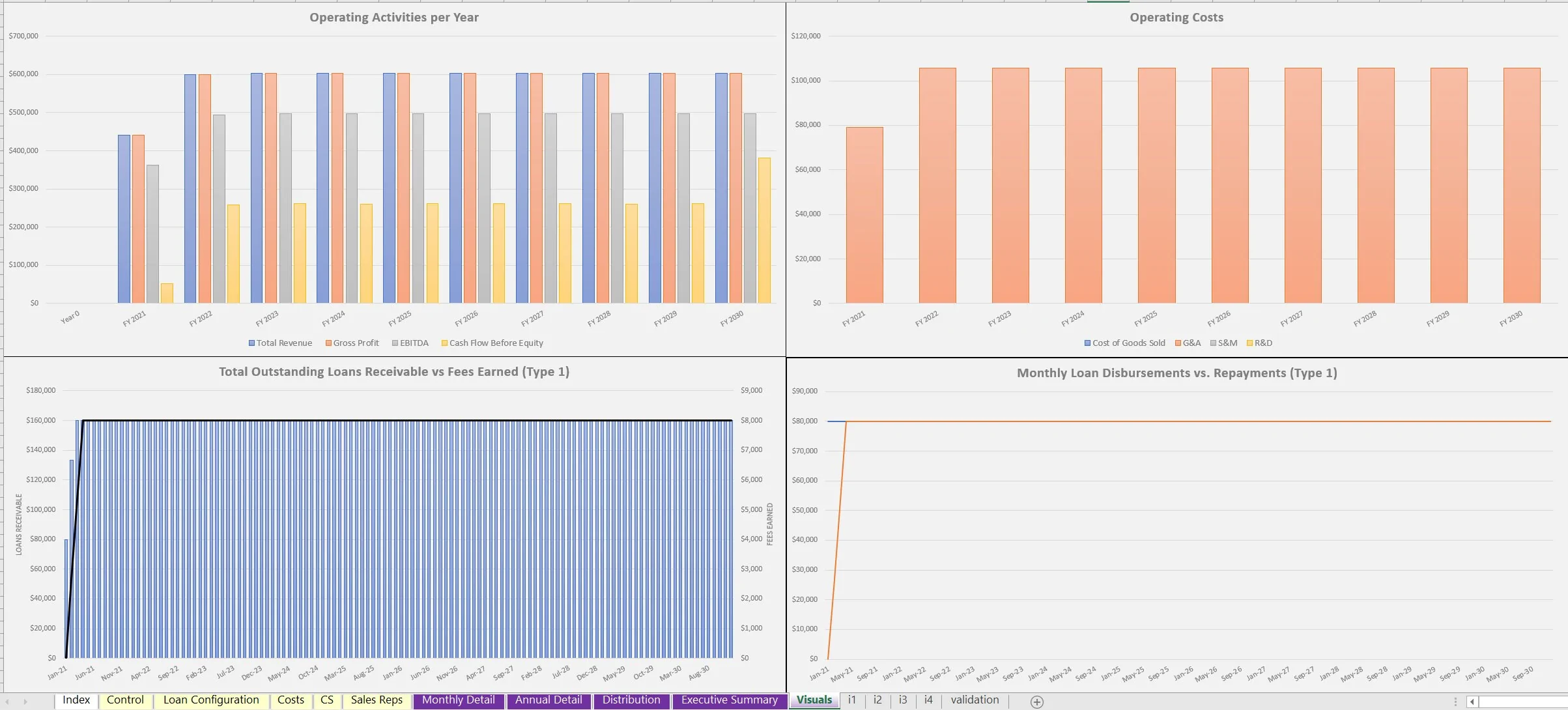

The actual margin made is the difference in the total annual flat fees collected against the interest paid to the line of credit. This is the base for how gross margins are earned.

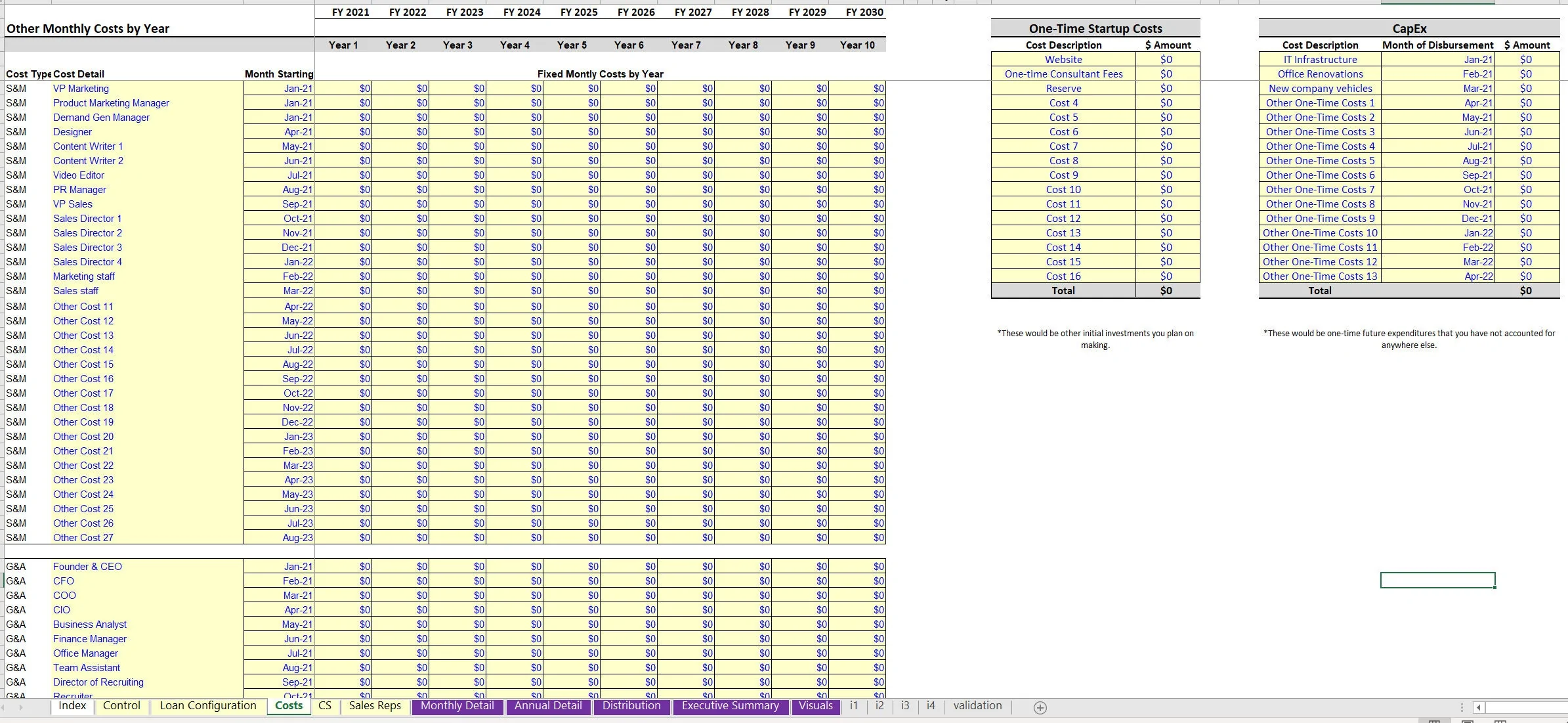

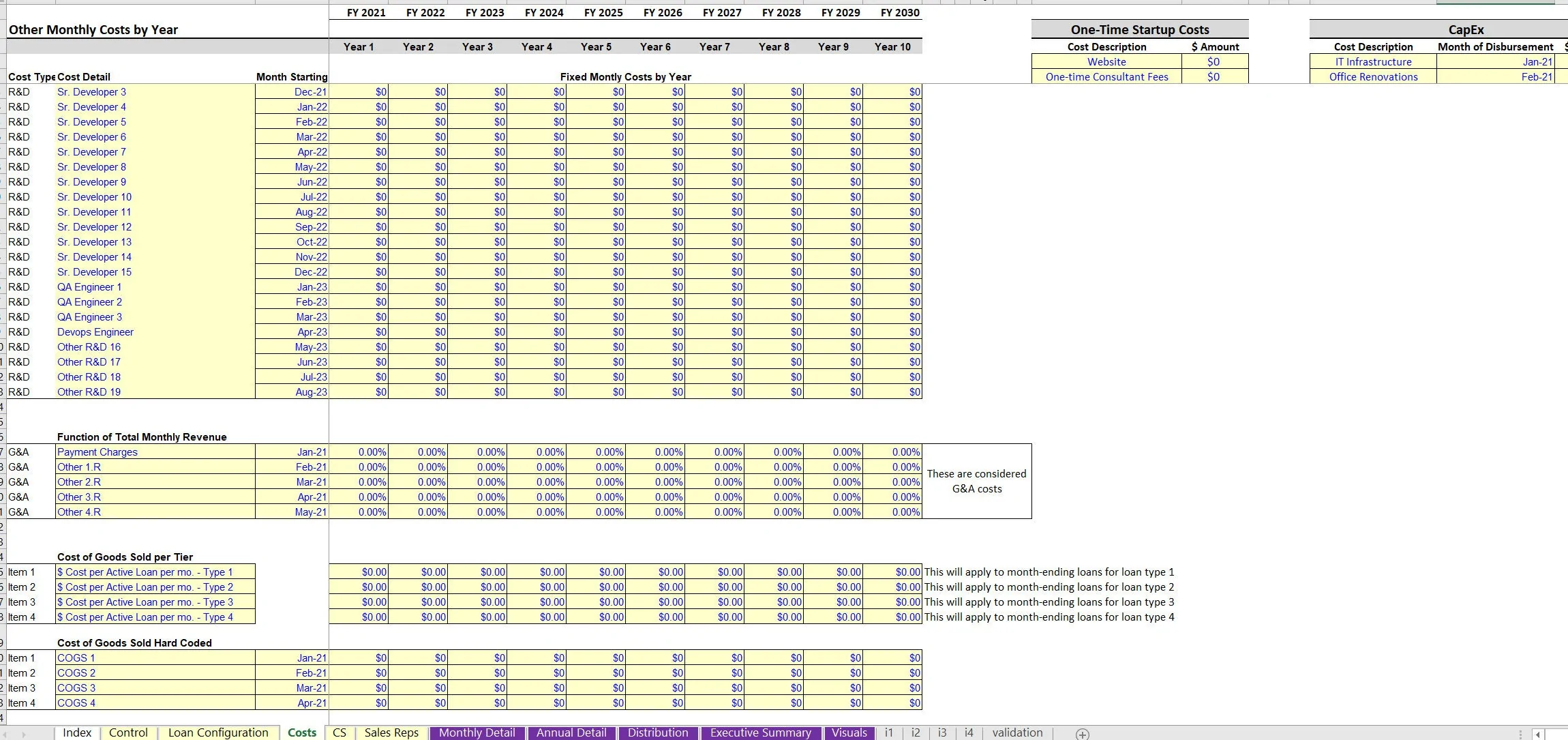

This Excel spreadsheet lets the operator play with all kinds of assumptions regarding the flat fee rate, the loan term, average loan amount, and the count of originated loans over time.

Note, it is very likely that the line of credit can only be made to originate loans and not pay for other operations costs such as rent / salaries / other overheads. This dynamic logic is built into the model for draws to the facility and repayment therein. If the operation is fully funded by equity, then there is no need to repay interest and instead it will just take an initial investment to cover the lending originations.

The lending originations (cash required to make the loans) will populate from the 4 loan types configured in the assumptions listed above. Equity could come from the operator or outside investors and a contribution/distribution schedule will display the cash flow splits based on defined inputs.

This model is a great way to see what kind of scale is required to become cash positive in operations as well as how much equity is going to be required at minimum to stay afloat based on operating burn and any interest payment obligations.

A flat default rate is applied to all loan repayments and hits the cash flow based on the month principal is repaid for all loan types.

A final terminal value is determined based on the total loans receivable multiplied by a multiple (it could be 1 or something different) less any loans payable (the facility) and less any seller fees / other fees related to the selling of the business/loan receivables.

Final output summaries include:

• Monthly and Annual P&L / Cash Flow Details

• Annual Executive Summary of high level financial line items

• Annual Contribution / Distribution summary

• IRR / equity multiple of project / operators / investors

• Lots of visualizations

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Flat Fee Money Lending Business Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Industry-specific Financial Models (40+)

This bundle contains 58 total documents. See all the documents to the right.